Birla Corporation June quarter net profit up 264%, EBITDA up 38%

Aug 05, 2025

VMPL

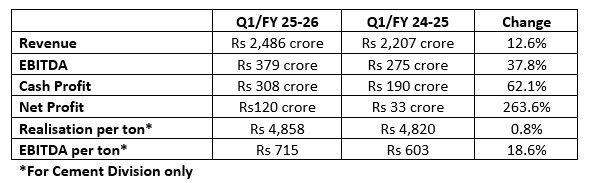

Kolkata (West Bengal) [India], August 5: Birla Corporation Limited recorded a consolidated revenue of Rs 2,486 crore for the June quarter, up 13% over last year, and delivered a net profit of Rs120 crore, up 264% year-on-year. Sales by volume for the quarter grew 9%.

The Company's consolidated EBITDA grew 38% to Rs 379 crore from Rs 275 crore in the same period last year. The growth in EBITDA was the result of improved cement sales, lower operating cost and a turnaround in jute.

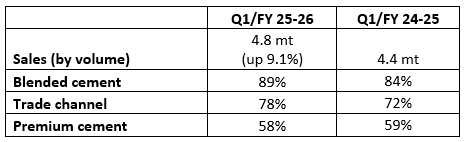

The Company's cement sales by volume during the quarter was at 4.79 million tons (mt) compared to 4.38 mt in the same period last year. Cement sales were affected by early arrival of the monsoon and depressed prices in some of the Company's core markets in central India.

The Company experienced mixed market conditions in different regions of operations. While the western and eastern markets were relatively buoyant, price and demand in central India remained muted. Further, the early onset of the monsoon in the later half of the quarter led to deceleration in demand and put pressure on prices across regions.

In the overall sales mix, while the Company benefited from improved prices in the west and east, conditions remained static in the central region, compared to the same period last year. As a result, overall realization for the quarter improved moderately to Rs 4,858 per ton. The Cement Division registered an EBITDA of Rs 364 crore in the June quarter, up 34% year-on-year. EBITDA per ton for the quarter at Rs 715 was up 19% over the same period last year.

The Cement Division's operating profit margin for the quarter was at 14.7% compared to 12.5% in the same period last year. Combined with flat prices, the Cement Division's profitability for the June quarter was impacted by extended maintenance shutdowns. The resultant fall in clinker production was partly made up through third-party clinker purchases to protect market share.

Clinker production during the quarter was 17% lower at 2.44 mt compared to a year ago. The Company, as a strategy, made conscious efforts to maximize clinker realization and contribution by driving up sales of premium products and blended cement.

As per the Company's stated strategy, it protected realization and value market share with focus on sales of premium brands and blended cement, while lowering sales of OPC and dependence on the non-trade segment. The growth in cement sales was led by the Company's flagship brand Perfect Plus. During the June quarter, Perfect Plus alone grew 19% by volume, driven by healthy sales in Rajasthan, Madhya Pradesh, Uttar Pradesh, Maharashtra and West Bengal. Sales of Unique Plus, another premium brand, grew 37% during the quarter, albeit on a lower base.

Sales of premium products during the June quarter accounted for 58% of total sales through the trade channel. Realization from these premium offerings was substantially higher than the popular brands, which significantly boosted profitability.

Amid an estimated pan-India cement demand growth of 4-5%, Birla Corporation Limited consolidated its market share in all key regions. In the east, the Company witnessed an 18% growth in cement sales, followed by 15% in the west. In the core markets in the central and northern regions, the Company's cement sales grew 7-8%.

The Company's blended cement portfolio witnessed healthy year-on-year growth of 16% in the June quarter. Blended cement accounted for 89% of the Company's total sales, compared to 84% in the corresponding quarter of last year. The biggest drivers were West Bengal and Rajasthan, where the Company registered a growth of 37% and 15%, respectively.

The Company benefited from benign fuel costs. Power and fuel costs per ton of cement production fell from Rs 1,019 a year ago to Rs 933 in the June quarter, a gain of 8.4%. The Company continued to ramp up the use of green power, which accounted for 26.9% of the total power consumed during the June quarter.

"With rapid scaling up of the Mukutban plant and profitable utilization of the Chanderia expansion, the Company is on a stable footing to focus on its next phase of growth, both with brownfield investments and new greenfield capacities," said Shri Sandip Ghose, Managing Director and Chief Executive Officer.

Jute: The Company's Jute Division staged a significant turnaround in the June quarter with a Rs 6.4 crore cash profit against a loss of Rs 3.9 crore in the same period last year, driven by a strong growth in sales, both in domestic and overseas markets.

The Division registered a 63% year-on-year growth in local sales, and 133% growth in exports in value terms. Even as raw jute prices went up sharply, the Division mitigated its impact on profitability by significantly reducing processing costs and boosting production.

To further increase productivity and profitability of the Division, the Company has taken several initiatives, including installation of advanced looms to retire old ones. The Division is also setting up a rooftop solar power generation facility, which, when commissioned at the end of the current financial year, will lead to substantial savings.

The leadership team is working towards turning Birla Jute into the most efficient jute processing unit in terms of cost, profitability and safety.

Birla Corporation Limited is the flagship Company of the MP Birla Group. Incorporated as Birla Jute Manufacturing Company Limited in 1919, it was given shape by Syt MP Birla. The Company has interest in cement and jute goods. Its Birla Jute Mills is the first jute mill started by an Indian entrepreneur. The Company and its subsidiary, RCCPL Pvt Ltd, have 10 cement plants in eight locations across the country, with an annual installed capacity of 20 million tons. The Company produces an array of cement products, under the MP Birla Cement brand, suited to different climatic conditions as well as consumer segments. It also sells construction chemicals and wall putty.

For more information, visit www.birlacorporation.com

(ADVERTORIAL DISCLAIMER: The above press release has been provided by VMPL. ANI will not be responsible in any way for the content of the same)