Hecta provides a new outlook for Banks' Repossessed Properties

Oct 04, 2022

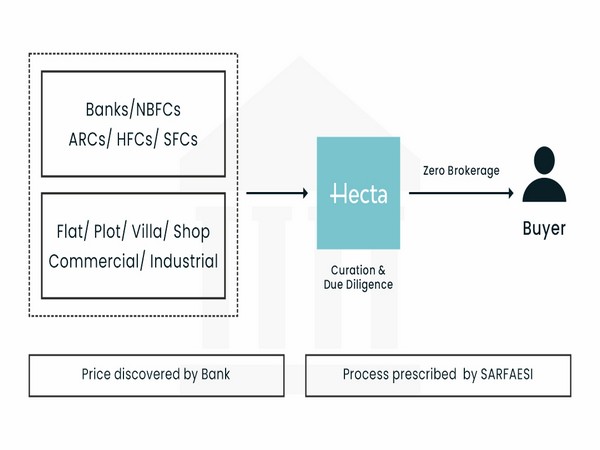

New Delhi [India], October 4 (ANI/Hecta): Banks have a lot of properties which they take possession of, if the borrowers pledge them against loans and don't pay back. They are referred to as repossessed properties.

Selling these has been a nagging pain point for banks for years. Not just banks but Housing Finance Companies, NBFCs, Cooperative Banks, State Financial Corporations have the same pain point. The banks publish notices in newspapers, on their respective portals, recovery agents and sometimes local brokers too. The problem for banks is that they are heterogenous and dispersed across the country.

On the other hand, people have a huge aspiration to buy real estate. However, they have specific requirements of buying residential or office space in a particular location and within a particular budget. They are open to buying properties from Banks because they are generally at a discount but do not have visibility and find it extremely difficult to sift through hundreds of them to find the relevant one, at the right time.

Hecta, launched today on this auspicious Vijayadashami, aspires to solve this problem at both ends with technology-driven user experience, proprietary matching algorithm and digital marketing techniques.

Currently, brokers buy these properties and flip them. Whatever can't be flipped can become residual. Brokers have a strong but limited local reach. Hecta can expand the visibility of these properties to the respective target segments across the country to generate leads. Furthermore, End-buyers need a lot of education and awareness to buy these repossessed properties directly from Banks. Hecta will focus on increasing awareness and offer a bouquet of defined due-diligence services from professional experts. Hecta can thus help buyers buy at discount and at the same time help banks realise higher. This is possible at both ends since the flipping is eliminated.

The beauty of repossessed properties is that the price discovery, the visiting schedule, the application process and the auction process, all terms and conditions are defined by the bank. They only accept money from banking channels thus, the buyers need not carry cash. Registration happens at the price sold, even if the transaction price is lower than the circle rate. After all, you are buying from an institution. The entire process is governed as per the SARFAESI act so there's full transparency in the transaction. This use-case is well suited to crack the Proptech space with the Fintech experience.

The repossessed inventory can range from a Goa Resort near a beach for 3 Crores, a Brand new flat for 13.75 Lakhs in Ghaziabad or a Half acre and 80' feet main road facing industrial plot in Noida for 8.7Crores. All these are live examples from the Hecta website and can be bought from respective banks. Hecta wants to be an enabler ecosystem for banks to market and resolve their NPAs. Hopefully, this would move the needle on NPAs among Banks and Financial Institutions. The banks can further lend these proceeds and grow their business.

This story has been provided by Hecta. ANI will not be responsible in any way for the content in this article. (ANI/Hecta)